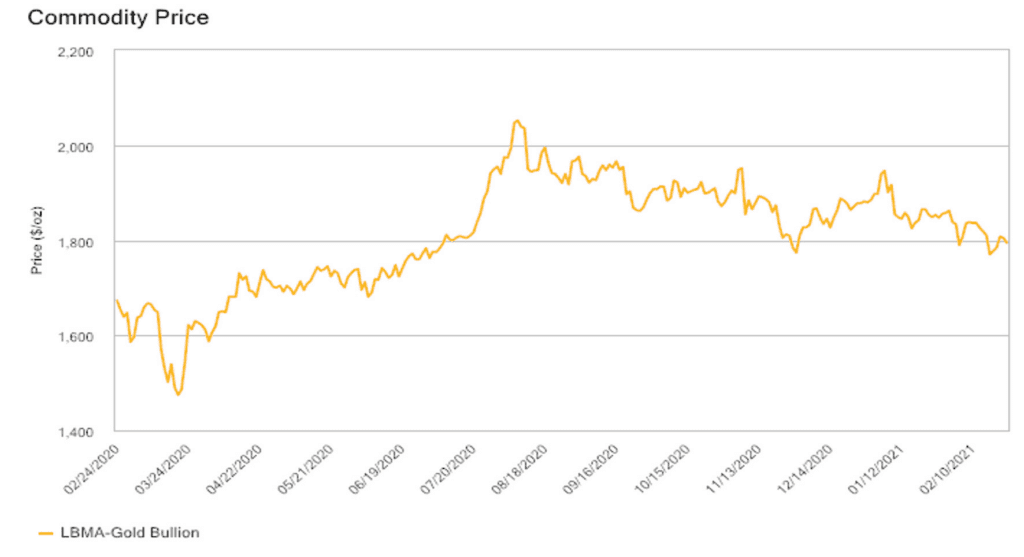

Gold as a commodity should continue to do well this year, despite prices experiencing a degree of volatility and a modest downturn in the first two months of 2021. On 24 February, gold was US$1,794.92 per ounce, down from a high of US$2,052.50 in August 2020, but still generally around the level it was at the same time last year, when the cost of an ounce of gold was US$1,673.86, according to data from S&P Global Market Intelligence.

Over the past three years, the general trend has been one of sustained growth, and this looks set to continue in what could be the beginning of a new commodities supercycle. Amidst the prospect of rising inflation, a coming U.S. fiscal stimulus bill, and a weaker U.S. dollar, gold prices have dipped slightly over recent weeks. However, with ongoing market volatility caused by concerns over the vaccine rollout, and especially the potential for inflation should the Federal Reserve decide to increase interest rates due to bond yield rises, physical gold, for many investors, is still a safe haven as part of a balanced portfolio – and will be for some time to come.

Gold mining, too, is experiencing something of a boom. Demand is driving an increase in exploration around the globe, from Western Australia to Brazil, and Ontario to numerous countries in West Africa. According to UK-based analytics firm GlobalData, overall global gold output fell by 5.2% in 2020 to 108M ounces, due to COVID-19 and mine shutdowns. However, the company has predicted that production will rebound and increase by 5.5% this year to 113.9M ounces. By 2024, production will rise to 124.1M ounces, which represents a 2.9% compound annual growth rate, according to the firm’s predictions.

So, for now, the prospects are generally fair for both gold as a commodity and the gold mining industry in general. But how is the yellow metal faring alongside its precious metal peers – silver, platinum, and palladium – and what could the future look like for them?

Silver

The silver market was firmly in the public eye at the beginning of 2021 as it was swept along in the Reddit trading saga. By 1 February, silver futures had surged to their highest levels since 2013 as a result of the short by Reddit day traders, and the price broke past US$30 per ounce before quickly subsiding.

While the squeeze was short-lived, silver prices are, at the time of writing, sitting around the US$28 mark and the overall market is bullish. This could be attributable to the fact that silver, unlike gold, is also an industrial metal. As the Biden administration steps closer to passing its proposed US$2T COVID-19 stimulus plan, this could increase demand for industrial metals and therefore the price of silver will rise accordingly.

Platinum

Platinum, like gold, began the year riding on a wave of optimism. On 15 February 2021, the precious and industrial metal broke through the US$1,300 an ounce level for the first time since late 2014, reaching a high of US$1,312.54 an ounce. This bullishness was driven mainly by the expectation of industrial demand brought about by tighter vehicle emissions rules and platinum, like palladium, is a key component of catalytic converters.

However, by 24 February, spot platinum fell to US$1,242.51 an ounce, which was the biggest one-day slide since 11 January, as reported by Bloomberg. This downturn was fuelled by concerns that prospects for economic recovery have already been priced into some metals, as well as higher U.S. Treasury yields and a stronger dollar reducing the appeal of bullion. It remains to be seen how platinum will perform throughout the year, but the slide indicates investors are taking a more cautious approach to economic recovery.

Palladium

Closely related to the fortunes of platinum is its sister commodity, palladium. The commodity is critical to the automotive industry as it is used in catalytic converters to create cleaner emissions. At the end of February 2021, the metal was trading at approximately US$2,339 an ounce, which is a significant increase from its position three years ago in late February 2018, when palladium was trading at around US$1,041 an ounce, data from S&P Global Market Intelligence show. The key factor driving palladium’s price hike is that it was in short supply throughout 2020, and this could continue in 2021 depending on how much of the metal is stockpiled by investors, according to Reuters.

So, there are plenty of factors at play affecting precious metal prices at the moment, not least of which is the growing concern that interest rate hikes will come into effect in the near future. The year so far has seen price surges across all four of the precious metals – gold, silver, platinum, and palladium – and then subsequent ebbs of varying proportions. What does seem to be the case, however, is that precious metals, like industrial metals and battery metals, are enjoying a period of renewed vigour. How long this can be sustained, and how smooth the journey will be, remains to be seen.

Comments 1