Tell us a little bit about your background?

I have been with The Copper Mark since the organization was founded. But my background is in mineral supply chains, sustainability standards, and assessments – all along the supply chain from the artisanal mine sites in the DRC to the SEC issuers in the US. That’s what has brought me to copper.

What is responsible copper and what are the criteria that you at The Copper Mark use to evaluate companies and projects with the view towards responsible copper?

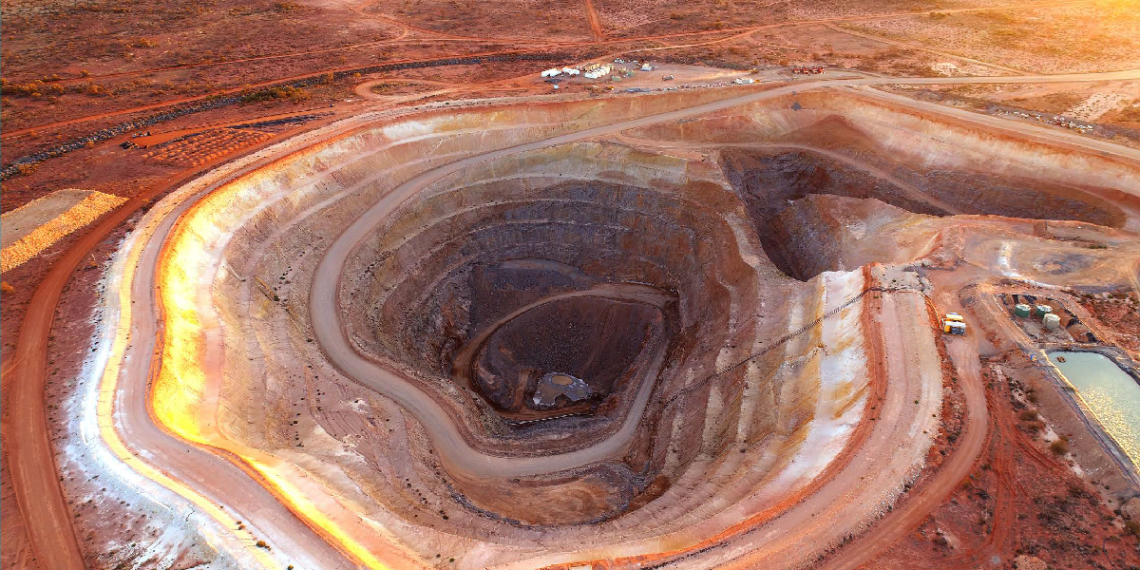

Put simply, responsible copper, for us, is copper that’s produced in a way which doesn’t harm people and the environment, and that contributes positively to the communities and societies in which copper is extracted.

The Copper Mark has a set of criteria. We have used the Responsible Minerals Initiatives Risk Readiness Assessment, which is 32 criteria across all environmental, social, and governance (ESG) issues. They range from responsible business practices and legal compliance, all the way to social topics like working hours, child labour, forced labour, and more.

They cover all the major topics around sustainability and responsible practices, and are drafted in a way that is management-systems focused. This means we look at each individual site that participates in The Copper Mark, such as a mine site or a smelter or refiner, and look at how the operations manage these different areas.

Let’s talk a little about some of the tangible impacts that you’ve seen from the growth of this sustainable development framework that The Copper Mark and others are doing.

A lot of the time the participants that come to us have done quite a bit of homework, and one of the impacts of voluntary standards is that companies tend to look at those before they sign up. They want to have a sense of whether or not they are able to meet this set of expectations, or if they are able to get the distinction they are looking for. And so a lot of the impacts we’re seeing are companies doing the assessments and starting to adjust their practices or to their management systems before they even join us.

In terms of tangible impacts, we have a bit more than 20% of globally mined copper that is covered by sites who have received The Copper Mark. We track the major areas where we see improvement opportunities for our participants. The four biggest topics where we see the most sites coming up as having improvement areas start with due diligence in mineral supply chains.

We’ve seen several of our participants publish a first-time due diligence report. Of course, you could say that’s just a report that they put out there, but it means they now have the systems behind them to implement supply chain due diligence and sign away that they can report on it publicly and disclose their practices.

We’ve also seen improvements around what we call “business relationships”. So that goes in the same direction as due diligence on your business partners. We’ve seen a lot of our participants expand what was maybe a narrower focus before on just one commodity, or just one type of supplier, to look more broadly and more in line with increasing due diligence expectations.

Greenhouse gas emissions is the third area where we’re seeing a lot of movement, and a lot of work is going into setting the right targets, disclosing carbon emission data, and more.

The fourth area is tailings management. We have adopted the global industry standard for tailings management as an expectation for The Copper Mark participants. Now we see a lot of the participants really making the effort to implement that standard, improve their practices, and ensure their management of tailings is safe.

What’s the breakdown and who’s responsible for the development of ESG practices for the industry overall?

I think investors will continue to have the very important role of putting ESG at the top of the agenda, making sure that there is follow-up, monitoring, and engagement over time, and that we’re not at the risk of green washing. That we’re not just going to accept company’s claims or nice targets that sit out there; they really have to be implemented.

Start by making ESG a priority from the very top of the organization downwards

Investors have a big role to play in getting the attention of senior management within companies. That’s one of the big changes I’ve seen over the last decade – the importance of ESG or sustainability within companies.

Do you see other initiatives similar to The Copper Mark in other industries? I know there’s been a growth responsible steel as well, but are there similar initiatives across the board?

Yes, there are probably too many at this point. You have initiatives that are more reporting focused, more focused on disclosures, which tend to be the ones that investors are primarily looking at. These tend to be more at the corporate level, so more focused on specific metrics or KPIs that need to be publicly disclosed.

But then you also have this kind of second universe, which is more about the performance standards or certification-type systems similar to The Copper Mark. Within those, you have a range of standards that really focus on mining and mining only, so we can address the salient impact at that end of the supply chain.

You then have a group that looks more at responsible sourcing, which tends to be a bit narrower in its focus on topics and looks a little more at the middle of the supply chain, such as processing.

Finally, you have the systems like The Copper Mark which are commodity specific and aspire to connect the full value chain. These vertical and horizontal standards work together and more or less interlink. It depends a bit on which system, of course, but you do see them appearing more and more. And certainly for a number of the major metals, like aluminium, copper, steel, that are traded, these are pretty much the systems in place at this point in time.

Do you have recommendations for companies that want to step up their ESG focus?

Start by making ESG a priority from the very top of the organization downwards. If there is support and there is priority to do business responsibly, then it flows through the whole organization.

There are lots of tools, frameworks, and standards companies can go to to benchmark their practices and receive external independent validation, which makes it easier to communicate back to their investors and their customers.

What are some of the key goals for The Copper Mark moving forward?

We are looking to bring on the majority of the industry. I’ve mentioned the 20% of globally mined copper; we do have another 80% that is not yet part of the system. So there lies our big goal, to make sure that we really move beyond the biggest and leading companies in this space. But we want get to the rest of the industry and make sure that copper is produced responsibly.