September 9, 2019

The saying “a baker’s dozen” refers to the number 13. It originated in England in the 13th century when all the king’s men required bakers to sell their goods by the dozen with a specific minimum weight or suffer a fine and perhaps worse.

So, savvy bakers loaded another loaf on the pan to ban the man. Earlier this week, I weighed in on the astounding rise of gold on our monthly commodities podcast for Kitco.com, now in its 10th season. Our usual alliterative title was: “Gold Has Gone on a Gallop” (Mercenary Musings Radio, September 3, 2019). And today, I tell you why.

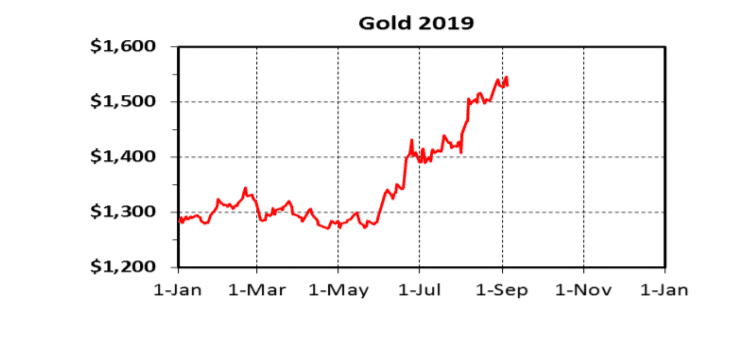

Bullion was $1270 per ounce on May 21 and is $1520 per ounce as I write this missive. Folks, that’s a 20% gain in three and a half months! It can be argued that gold has run up too far too fast and is overdue to test downside resistance. I agree with that assessment but at this juncture, why don’t we just sit back and enjoy the ride?

Here’s the year-to-date chart illustrating that 2019’s gains have occurred entirely during the late spring and summer:

The impressive uptick has come mostly during the traditional summer doldrums, a season in which the gold price usually founders and sometimes reaches its yearly low.

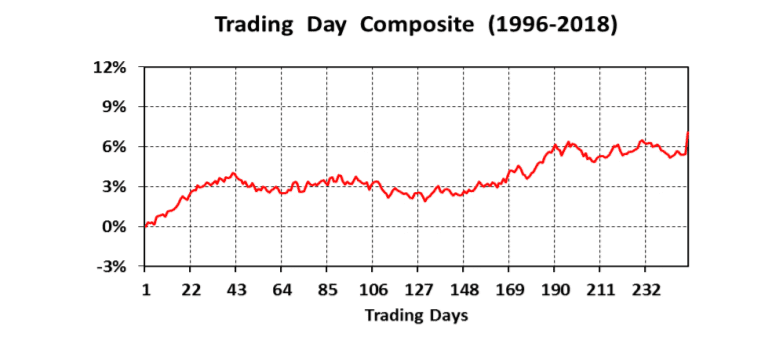

Below is a normalized record of the yearly gold price composited for the past 23 years; each month is represented by about 21 days of trading. Note in particular the downturn to flat market for gold from the beginning of June (day 106) thru late August (day 169). That’s the usual summertime blues:

My baker’s dozen of reasons why gold has made an unprecedented move to the upside this summer is as follows:

1. Lowest interest rates since 2016; inverted yield curve for US treasuries; negative rates in EU.

2. Ever-increasing world government debt at $63 trillion; $15 trillion at negative interest rates.

3. Central bank bullion buying, especially by 2nd and 3rd World countries.

4. Ongoing trade disputes between the US and China and also the US and the EU.

5. A slowing world economy, especially in China and attributable to its trade war with the US.

6. Renewed European Union economic stimulus that includes buyback of its own bonds.

7. Major banks and other financial institutions long speculations on the gold price.

8. Increased holdings of paper gold in ETFs, now at nearly 2500 tonnes and highest since 2016.

9. Ongoing devaluation of all the world’s fiat currencies.

10. Long-lived gold bear market; 6.5 years since the price crash from $1680 to as low as $1050.

11. Geopolitical turmoil: China-Hong Kong; Iran-Venezuela sanctions; UK-EU over Brexit.

12. Fears of an imminent world recession stoked by mainstream media sensationalism.

13. Increasing demand for physical gold by private hoarders.

I can summarize my list of reasons for gold’s recent run up in one succinct paragraph:

Gold is money. It has filled that role over the entire course of human history. Gold is the world’s only safe haven and insurance policy against financial calamity and economic collapse. Smart money hoards gold to preserve its wealth.

Remember the golden rule: He who has the gold makes the rules.

Ciao for now,

Mickey Fulp

Mercenary Geologist

Contact@mercenarygeologist.com

Acknowledgment: Lukas Smith is the research assistant for MercenaryGeologist.com.