Cobalt is a chemical element with the symbol “Co” and the atomic number 27. Known informally as the “blue” metal, cobalt has a silvery appearance with a bluish tinge, it is lustrous, and highly magnetic. According to the National Library of Medicine, cobalt is an organically occurring element found in soil, water, rocks, plants, and animals. The commodity is used in numerous and often critical industries, such as chemical, industrial, and military applications.

Cobalt was discovered by George Brandy, a Swedish chemist, in 1739. Its major ores are cobaltite and erythrite. The blue metal is usually recovered as a by-product of other elements, including copper, iron, and nickel.

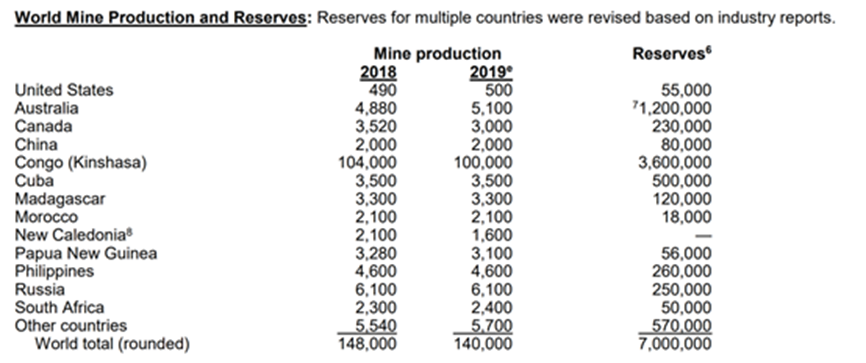

The United States Geological Survey (USGS) stated in its January 2020 Mineral Commodity Summaries Report that most of the global cobalt resources are located in Democratic Republic of Congo (Kinshasa), Australia, and Cuba. The USGS presented the known cobalt reserves in the table below:

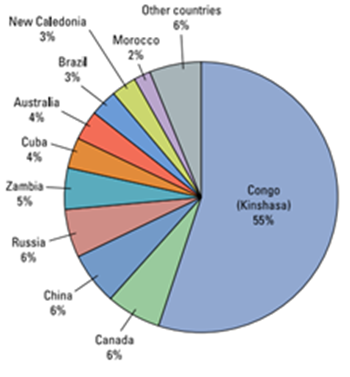

Congo currently contains around 55% of the world’s cobalt reserves, the other countries each contribute less than 10% of the total. In all cases except the Bou Azzer district (Morocco), cobalt is produced as a by-product of other metals. The proportion of cobalt reserves is expressed in the chart below provided by the USGS:

According to Britannica, in the copper-cobalt bodies of central Africa and Russia, cobalt occurs as:

- Sulphides

- Oxide minerals heterogenite

- Asbolite

- Carbonate sphaerocobaltite

In the copper-nickel-iron sulphide mines of Australia, Russia, Canada, and other regions, cobalt occurs in the place of nickel in many minerals.

Cobalt arsenides are predominantly mined in Morocco, with other countries producing a significantly reduced amount. They include:

- Smaltite

- Safflorite

- Skutterudite

- Cobaltite

- Arsenate erythrite

These all contribute to cobalt’s list of only primary ores.

How cobalt is mined

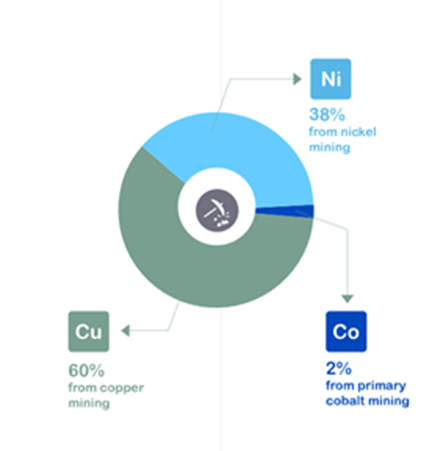

The diagram below represents cobalt being mined as a by-product across the world. According to the Cobalt Institute, 98% of cobalt production is mined as a by-product of nickel and copper mining.

Methods of mining cobalt include both underground and surface mining. Large cobalt deposits are also present on the seafloor, although research is currently being conducted to explore the best methods of extraction.

Various nickel and copper ores are treated by both pyrometallurgical and hydro-metallurgical techniques. The vast proportion of cobalt is mined from large scale mines that are controlled by substantially sized mining companies. Large mining companies such as Glencore PLC (LSE: GLEN), China Molybdenum (HKEX: 3993), and Vale (NYSE: VALE) dominate the cobalt mining sector.

Rising prices have also triggered cobalt market growth, particularly in artisanal mines or small-scale miners in the DRC. These are informal cobalt mining activities often carried out using limited technologies by independent miners.

The value of cobalt

Cobalt is not an especially rare commodity. According to statista.com,cobalt ranks 32nd in global abundance among metals, yet innovations in the battery industry have seen overall cobalt demand soar. This rising demand for lithium-ion batteries has made cobalt increasingly more expensive. Statista forecasts that in 2025, the worldwide demand for cobalt use in batteries will amount to 117,000 tonnes, with another 105,000 tonnes needed for other applications.

Statista forecasts that in 2030, electric vehicle batteries alone will account for an estimated 176,000 metric tonnes of global cobalt demand. In contrast, non-battery applications of cobalt is only expected to amount to 65,000 metric tons of cobalt demand globally by that year.

What is cobalt used for?

Cobalt is predominantly used in the chemical and metal industries. According to the Cobalt Institute, cobalt’s main function in the petroleum and chemical industries is to be used as a catalyst to remove the sulphur from oil.

Cobalt catalysts also help companies reach greenhouse gas emission targets by lowering the activation energy (e.g pressure temperature) needed for industrial processes such as the creation of polyester. The Cobalt Institute also states that the use of cobalt in catalytic applications strengthens the climate change initiatives for the reduction of global greenhouse gases. For example, petrol and diesel for cars can only be sold after being processed with catalysts containing cobalt compounds which reduce sulphur and nitrous oxide emissions.

Cobalt also maintains a principal use in producing alloys with iron, nickel, and other metals. According to the National Library of Medicine, when cobalt is combined with these other metals, it produces Alnico, an alloy with strong magnetic strength. Stellite alloys can also be produced with combinations of cobalt, tungsten, and chromium. Stellite alloys are predominantly used for heavy duty, high-temperature tools.

Mining cobalt for electric car batteries

Cobalt is set to play a key role in the global drive to reduce C02 emissions, thanks to its role as an important component in the production of electric vehicles. The key materials used in the electric vehicle (EV) – cobalt, nickel, copper, graphite, and manganese – are to see an enormous rise in spot price due to skyrocketing battery demand.

S&P forecast a cobalt market boom, with demand expected to double by 2030.This rise will be supported by new EV model launches and increasingly stringent environmental government legislation regarding the automotive sector.

Cobalt demand

The combination of stringent targets to reduce carbon emissions, the move towards an electric fleet, and the elimination of fossil fuels once facilitated cobalt demand growth.

However, China’s EV industry is now switching away from nickel, cobalt, and manganese (NCM) chemistry to cheaper lithium iron phosphate (LFP) batteries, meaning cobalt demand will not grow as rapidly as previously expected.

Also, reportedly adding to new cobalt supply will be those from China’s CMOC Group Tenke Fungurume mine (TFM), in the Democratic Republic of Congo (DRC), the world’s largest producer, after a one-year stoppage caused by a dispute with the government.

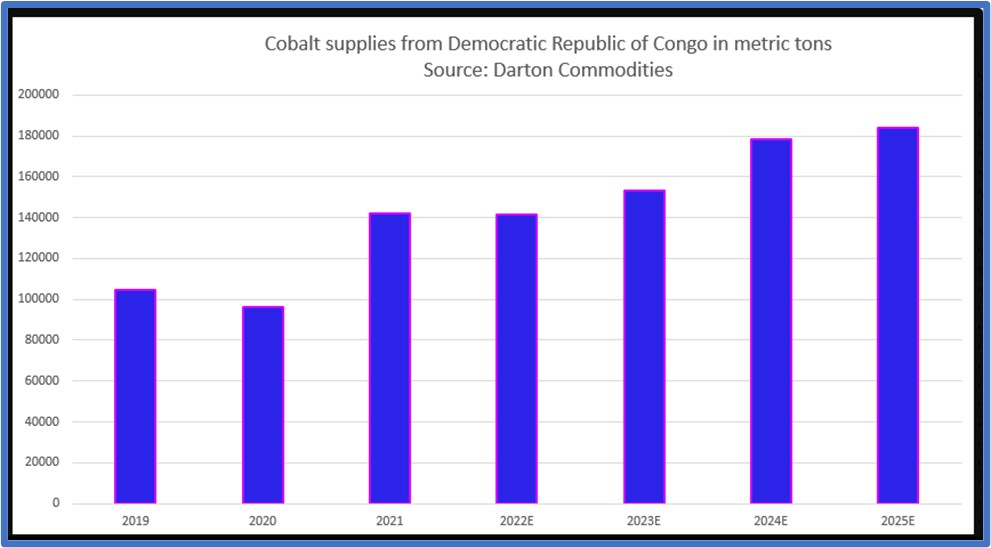

Global cobalt supplies in 2022 were estimated at nearly 190,000 metric tonnes, with the surplus at around 10,000 metric tonnes. Surpluses of the blue metal are expected to reach 10,200t and 10,400t in 2024 and in 2025, respectively.

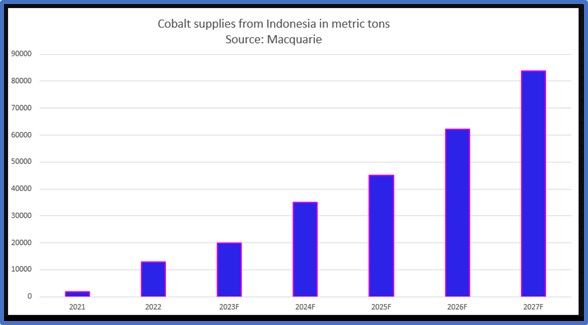

Furthermore, if Chinese firms are successful in increasing capacity in Indonesia, cobalt supplies from the world’s second largest producer will jump to 83,800t in 2027, more than 30% of the total from 10% in 2022.

Cobalt price analysis

According to S&P Global Platts Assessment, since the start of 2021 European cobalt metal prices rose an estimated 88.7% to US$30 per pound, the highest recorded level since December 2018. This was instigated by logistical issues, particularly supply bottlenecks.

Cobalt price history

Previously, cobalt reached an unprecedented high of US$95,250 per million tonnes in March of 2018.

According to Reuters, 2019 saw a drop in cobalt price sparked by rising supplies from the artisanal and industrial sectors in the DRC, and a surplus of cobalt chemicals produced in China.

However, Trading Economics global macro models predicted cobalt to trade at around US$70,905.60/Mt at the end of Q1 2022.

The three-month London Metal Exchange price for cobalt dropped 35.7% year on year to US$33,420/mt as of 1 December 2023 according to S&P Global Market Intelligence data. As of 22 December, the three-month price dropped further to US$29,135/mt.

Spot Price

As reported by S&P, the current cobalt spot price is US$29,135/t.

According to Trading Economics, cobalt is expected to trade at US$28491.12/T by the end of this quarter. Looking further ahead, it is estimated to trade at US$26643.96/t in 12 months time.

Cobalt outlook

Towards the end of 2023, Reuters reported that the surging supplies of cobalt from Indonesia and Africa are forecast to outpace demand from EVs, generating large surpluses over the next couple of years which will likely keep prices of the metal under pressure, combined with advancements in EV battery technology.

However, the Financial Conduct Authority (FCA) expects cobalt-based battery chemistries to remain the most advanced technology, especially for EV purposes, bringing hope to the commodity’s outlook.

Also, the possibility of sectors other than EVs using cobalt is on the rise, making investments feasible in the long run.

To stay up to date with the latest developments in the global cobalt industry and market, be sure to check out The Assay’s news centre.